The Evaluator Winter 2023

Arizona Appeals Court Allows Non-Taxable, Intangible Assets to Increase Taxable Value of Power Plant

Intangible assets, like leases, contracts and other business agreements, that benefit the business operated at a property are non-taxable under Arizona property law. Click here to learn more.

Colorado Supreme Court Hears Marathon Oral Arguments in Coordinated Legal Cases Seeking Off Cycle Revaluation for Properties Impacted by COVID-19 Pandemic and Related Government Restrictions

The Colorado Supreme Court recently heard oral arguments in eleven coordinated cases brought by property owners seeking revaluation of their properties in 2020, an off cycle year. Click here to learn more.

Missouri Tax Commission Finds That LIHTC Property Used Exclusively for Charitable Purposes is Exempt from Real Property Taxes

At issue is Missouri’s real property tax exemption for property “actually and regularly used exclusively . . . for purposes purely charitable, and not held for private or corporate profit.” Click here to learn more.

West Virginia Supreme Court Finds That the Trial Court Erred in Reversing a County Board of Assessment Decision Where Taxpayer Evidence Did Not Prove Error in the Assessor’s Cost Approach

At issue in these consolidated matters was the value of two properties owned by separate and unrelated entities. Click here to learn more.

OTHER VALUATION HEADLINES FROM ACROSS THE COUNTRY (CLICK HERE TO READ MORE)

Indiana Tax Board Reduces Valuation of Cabela’s Store

Iowa Supreme Court Reinstated Polk County’s Original Assessment of Corporate Office Buildings

New York Appellate Court Upholds Supreme Court’s Decision in Dispute over Mall’s Valuation

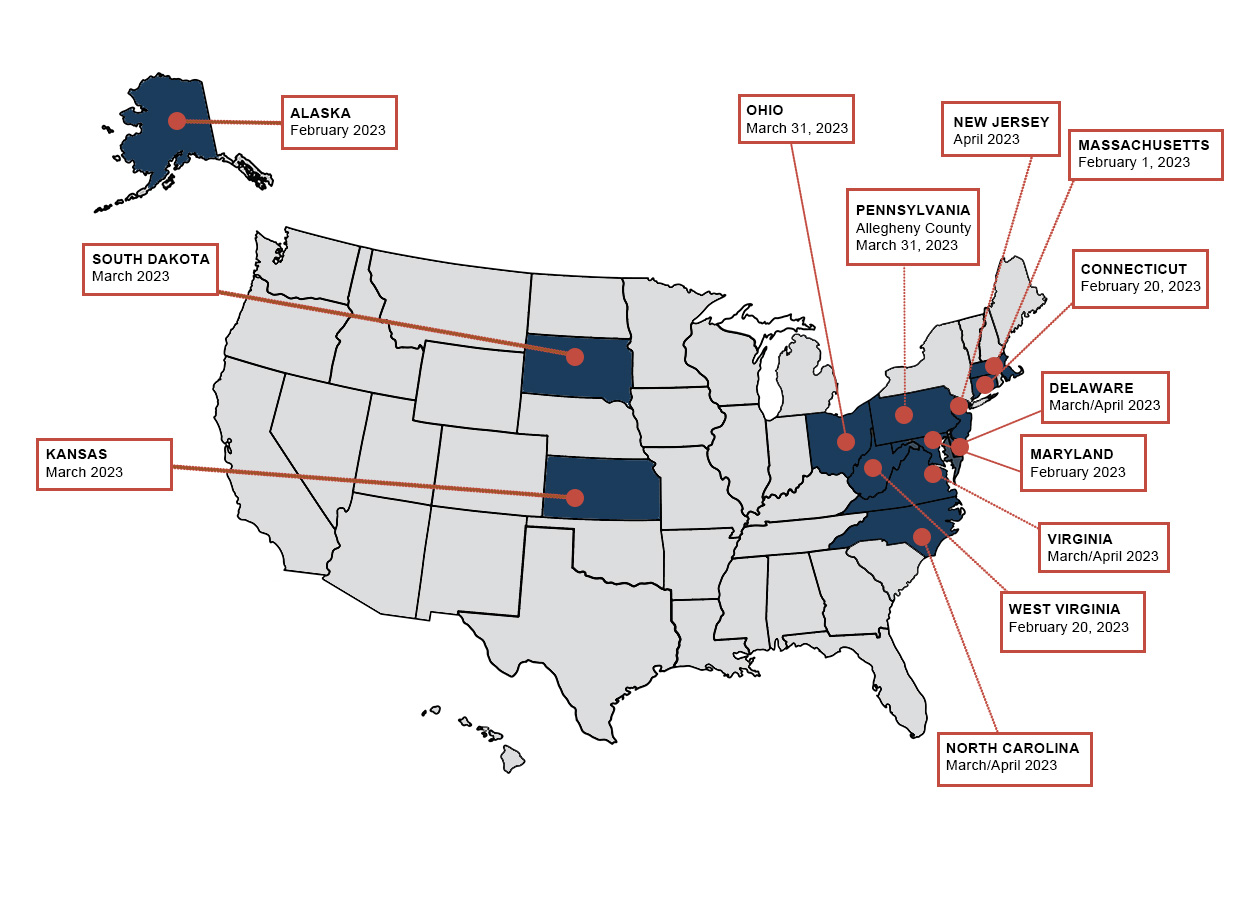

Deadlines Looming Across the U.S.

Taxpayers seeking to contest real property tax values established by assessing jurisdictions across the country often have a short window of opportunity to contest their new valuation. This time frame varies by state and by local jurisdiction, and in many cases begins to run upon the mailing of a new value notice. Below is a map of states/jurisdictions with upcoming appeal deadlines:

Time to File Real Property Tax Complaints in Ohio for Tax Year 2022

The State of Ohio requires counties to reappraise real property tax values every six years. In the interim, the counties are required to update values in the middle of that cycle. This cycle is not evenly distributed amongst Ohio’s 88 counties. Click here to learn more.

Vorys Expands Nationwide Property Tax Team with Experienced Texas Tax Lawyer

Vorys recently announced that William Noe, an attorney with nearly 20 years of experience in real estate and real estate-related taxation matters, has joined the firm’s property tax team in Texas. Noe has experience in all areas of Texas property tax, including market and equal and uniform value appeals, personal property tax appeals, delinquent tax suits, exemption qualification and appeals, and economic development incentives. Noe’s practice includes representing clients in property tax appeals to Texas district courts and, if necessary, in subsequent appeals to Texas appellate courts and the Texas Supreme Court. Read our announcement here.