Labor and Employment Alert: Roadmap to Health Care Reform Pay-or-Play Penalties

IRS proposed regulations (published December 28, 2012) are a roadmap to the employer pay-or-play penalties going into effect in 2014 under the Patient Protection and Affordable Care Act (the ACA). Employers may rely on the proposed regulations until further guidance or final regulations are published. Start your engines! Despite helpful transitional rules, employers have some distance to cover in 2013 in order to be ready for 2014.

IRS proposed regulations (published December 28, 2012) are a roadmap to the employer pay-or-play penalties going into effect in 2014 under the Patient Protection and Affordable Care Act (the ACA). Employers may rely on the proposed regulations until further guidance or final regulations are published. Start your engines! Despite helpful transitional rules, employers have some distance to cover in 2013 in order to be ready for 2014.

Background

Applicable large employers will be subject to two types of pay-or-play penalties starting in 2014:

- No-offer penalty – Imposed on an applicable large employer member when it fails to offer health coverage to substantially all of its full-time employees (and their children) and one or more of its full-time employees buys health insurance on an exchange with premium assistance.

On an annual basis, the no-offer penalty equals $2,000 times [the number of full-time employees employed by the member minus the member's ratable share of 30].

- Unaffordable/inadequate coverage penalty – Imposed when an applicable large employer member offers medical coverage that is unaffordable or inadequate and one or more of its full-time employees buys health insurance on an exchange with premium assistance.

On an annual basis, the unaffordable/inadequate coverage penalty equals $3,000 times the number of the member's full-time employees who are getting premium assistance.

Determining whether your business is subject to penalties, when your business has incurred a penalty, and the amount of the penalty is a multi-step process. A flowchart is available here.

Transitional rules:

The IRS delayed penalties for employers with fiscal year plans. If your plan year is something other than the calendar year, you won't incur a no-offer penalty or an unaffordable/inadequate coverage penalty for any month prior to the first day of the 2014 plan year for a full-time employee if:

-

at least one-quarter of your employees are enrolled in the fiscal year plan or at least one-third of your employees were offered coverage under the fiscal year plan during the last open enrollment; and

-

the full-time employee is offered affordable, adequate coverage no later than the first day of the 2014 plan year.

A more restrictive transitional rule delays the application of the unaffordable/inadequate coverage penalty for full-time employees who are eligible for unaffordable or inadequate coverage prior to the 2014 plan year provided that they are offered affordable, adequate coverage for the 2014 plan year.

The IRS also provided a 2014 transitional rule that is intended to shield applicable large employers contributing to a multiemployer plan from incurring penalties related to employees offered affordable, adequate coverage by the multiemployer plan.

Aggregate affiliated entities to determine "applicable large employer" status

The pay-or-play penalties only apply to "applicable large employers." An "applicable large employer" is an employer with at least 50 full-time and full-time equivalent employees in the preceding calendar year.

Transitional rule: For purposes of determining applicable large employer status in 2014, you have the option to count employees in a six-month period (rather than the entire year of 2013).

In determining "applicable large employer" status, you must aggregate employees of entities in: (a) a controlled group of corporations; (b) trades or businesses under common control; and (c) an affiliated service group. If you have a question as to whether your business is an applicable large employer (i.e., will be subject to the pay-or-play penalties in 2014), please let us know. If you are an applicable large employer and you don't have a compliance strategy, you could inadvertently trigger costly penalties.

Disaggregate affiliated entities to calculate penalties

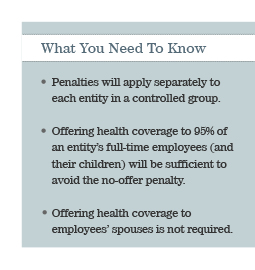

Good news! Although you have to aggregate affiliated entities for purposes of determining whether your business is an applicable large employer, penalties are calculated separately for each entity (called an "applicable large employer member"). Note that flow-through entities (like limited liability corporations) count as separate entities for purposes of this rule.

Planning point: The separate calculation of the no-offer penalty for each employer member may provide an opportunity to structure businesses to reduce the impact of the no-offer penalty on an applicable large employer that expects to offer health coverage to some – but not all – of its full-time employees.

Substantial compliance is good enough

An applicable large employer member can avoid the no-offer penalty by offering coverage to 95% of its full-time employees (and the employees' children). The failure to offer coverage to the other 5% of the member's full-time employees will not trigger a no-offer penalty – regardless of whether the failure is inadvertent or by design.

For an applicable large employer member with fewer than 100 full-time employees, the substantial compliance standard is even more favorable. The applicable large employer member can avoid the no-offer penalty by offering coverage to all but five (5) of its full-time employees, even though the resulting offer of coverage would be to less than 95% of the member's full-time employees.

Identification of full-time employees

One of the significant tasks imposed on applicable large employers is the identification of full-time employees in accordance with detailed IRS guidelines.

IRS guidelines provide for three consecutive periods:

- Measurement period – A full-time employee is an employee who works an average of at least 30 hours per week (130 hours per month) during the measurement period. The employer must pick a measurement period of between three and 12 months. For this purpose, an employee is credited with all hours for which he or she is entitled to payment (including vacation and sick time).

― If an employee terminates employment and is rehired 26 or more weeks later, the employee may be treated as a new employee.

― If an employee terminates and is rehired fewer than 26 weeks later, he or she must be treated as a continuing employee. For example, if the rehire is in the same measurement period, the rehired employee gets credit for hours before the termination.

― The IRS proposed special rules for calculating hours during paid leaves of absence; unpaid FMLA and military leave; and gaps in the normal work schedule for educational institutions. Please let us know if you want details.

- Administrative period – The administrative period follows the measurement period. During the administrative period, the employer tallies hours during the measurement period and provides enrollment materials to any employees determined to be full-time.

- Stability period – The stability period follows the administrative period. Any employee who was determined to be full-time based on hours during the measurement period must be treated as full-time during the stability period. The stability period for employees determined to be full-time must be at least six (6) months and no shorter than the measurement period.

A summary of the parameters for measurement, administrative and stability periods is available here.

Transitional rule: If an employer wants to have a 12-month standard stability period starting in 2014, the employer would normally need to have a 12-month standard measurement period starting in 2013 or even 2012. The IRS recognized that is problematic, given the date of publication of the proposed regulations, so it provided a transitional rule: You may use a six-month transitional measurement period in 2013, even if you plan to use a 12-month standard stability period in 2014. This transitional measurement period:

-

may be shorter than 12 months but cannot be less than 6 months;

-

must begin no later than July 1, 2013; and

-

must end no earlier than 90 days before the first day of the plan year beginning on or after January 1, 2014.

You'll have to offer health coverage to children – but not spouses

In a welcome development, the IRS has decided that an applicable large employer member will need to offer coverage to the children of full-time employees – but not the spouses of full-time employees – in order to avoid the no-offer penalty.

The children to whom coverage will need to be offered are:

- children by birth, adoption and placement for adoption;

- stepchildren; and

- (surprisingly) foster children.

Transitional rule: If your health plan does not currently offer coverage to employees' children (or, e.g., does not offer coverage to employees' foster children), you have until 2015 to conform your definition of eligible children. You will not be subject to the no-offer penalty for failing to offer coverage to a full-time employee's children (as defined above) until 2015.

Planning points: Since the employee contribution for single coverage is used for determining affordability for purposes of the unaffordable/inadequate coverage penalty, an employer will not be subject to penalties for offering unsubsidized family coverage.

The fact that an employer need not make coverage available to employees' spouses in order to avoid the no-offer penalty presents a planning opportunity to those employers that want to make a basic (minimally affordable and minimally adequate) health plan option available to newly eligible employees in 2014. In addition, employers that have already implemented spousal exclusions will not incur the no-offer penalty as a result of those exclusions.

New ways to demonstrate your health coverage is affordable

If your health coverage is not affordable and one or more employees qualifies for premium assistance to buy individual health insurance on an Exchange, you will incur an unaffordable/inadequate coverage penalty. To determine "affordability," you divide a numerator by a denominator, as described below. A result that does not exceed 9.5% is deemed to be affordable for purposes of the unaffordable/inadequate coverage penalty.

- Numerator of the affordability fraction – There had been a question as to whether the numerator of the affordability fraction would be, for employees with dependents: (a) the employee contribution for single coverage; or (b) the employee contribution for family coverage. Fortunately, the IRS decided to use the employee's contribution for single coverage for purposes of the three safe harbors (listed below) applicable to the unaffordable/inadequate coverage penalty. (The IRS did not address what contribution is used in the numerator of the affordability fraction for determining affordability outside the safe harbors.) If you have more than one option for medical coverage, you may use the least expensive option providing adequate coverage (i.e., 60% minimum value). The IRS has not yet addressed how smokers' and wellness premium differentials are treated.

- Denominator of the affordability fraction – The denominator of the affordability fraction is supposed to be employee's household income. Of course, you (as an employer) won't know your employees' household income (and household income is not in fact knowable until after the close of a year). To simplify the determination of affordability, the IRS offers three safe harbor options:

― Form W-2 safe harbor – Form W-2 Box 1 income for the months during which the employee was eligible for coverage.

― Rate of pay safe harbor – A salaried employee's monthly salary or an hourly employee's rate of pay multiplied by 130 hours for the months during which the employee was eligible coverage.

― Federal poverty line (FPL) safe harbor – The federal poverty line for a single individual. For 2012, the federal poverty line for a single individual was $11,170.

For example: Assume an employee is paid $8.00 per hour, works 1,560 hours per year, and defers 5% of his pay into a 401(k) plan.

|

Form W-2 Safe Harbor |

Rate of Pay Safe Harbor |

FPL Safe Harbor |

|

9.5% X ($11,856 ÷ 12) = $93.86 |

9.5% X $8.00 X 130 = $98.80 |

9.5% X ($11,170 ÷ 12) = $88.42 |

So long as the employee's share of the monthly premium does not exceed $98.80, the coverage is deemed to be affordable. However, although the three safe harbors apply for purposes of determining the employer's unaffordable/inadequate coverage penalty, an employee's eligibility for premium assistance to buy health insurance on an exchange will be based on the employee's household income.

Grace period for payment of employee contributions

Normally, an employee makes his or her contribution for health coverage by payroll reduction. However, there are situations where pay is not sufficient to withhold the employee's contribution for health coverage (e.g., tipped employees, reduced work schedules, and leaves of absence). An employer may bill the employee for missed contributions and will not be treated as failing to offer health coverage if the employer ends health coverage because the employee fails to pay the required contribution within a 30-day grace period (comparable to the grace period for COBRA premiums).

***

This alert is a summary and cannot include all details that may be relevant to your situation. As always, please contact us if you want more information on these developments or other employee benefits matters.